Overview

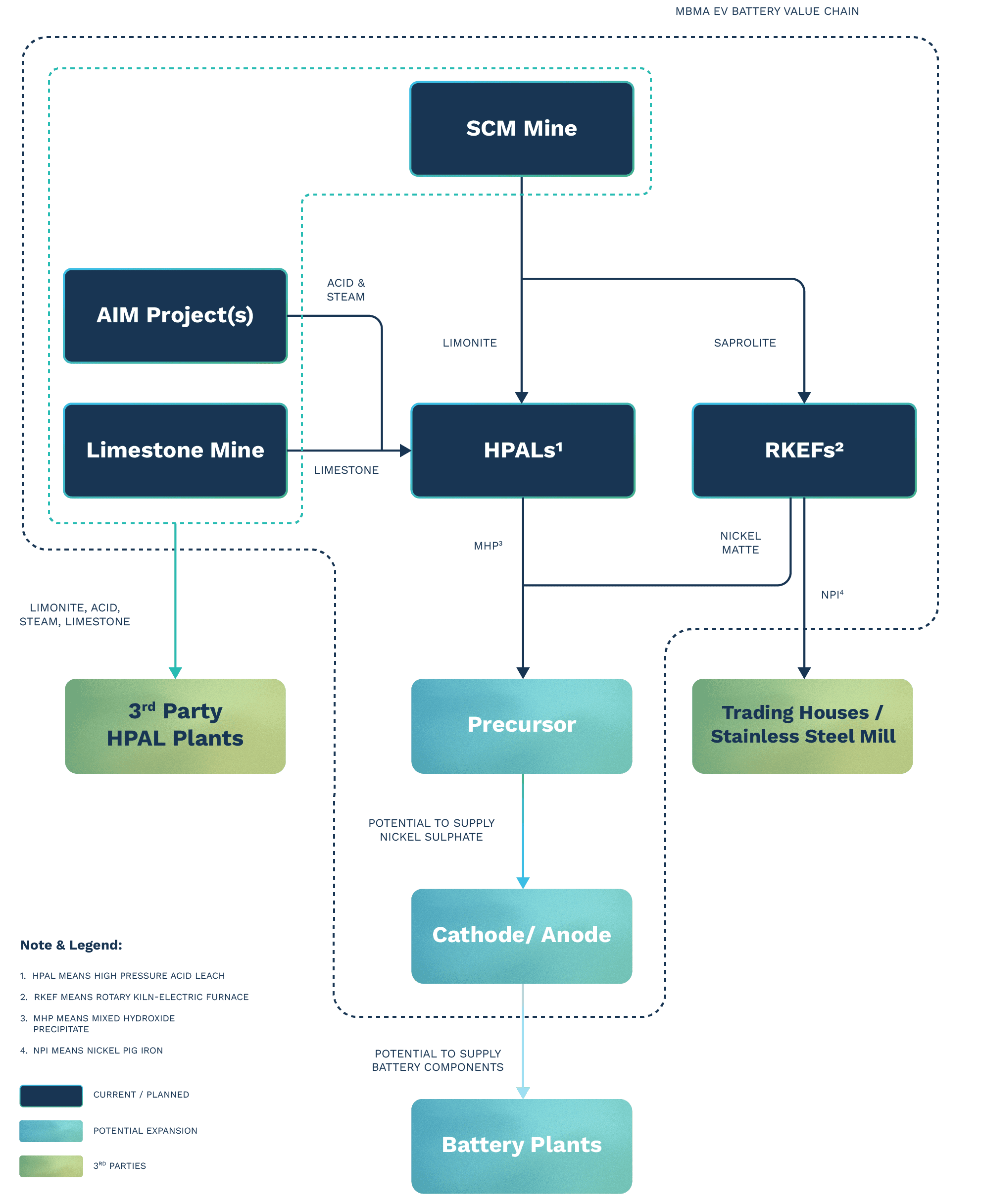

PT Merdeka Battery Materials Tbk (“MBMA”) owns high-quality assets in the strategic materials and EV battery value chain, with successful acquisitions made in 2022 to expand and develop operations in Indonesia.

MBMA is majority-owned by of PT Merdeka Copper Gold Tbk (MDKA), which holds the controlling stake through its subsidiary, PT Merdeka Energi Nusantara.

Our portfolio includes:

SCM Mine

(51.0% MBMA; 49.0% Tsingshan Group)

Regarded as one of the world’s largest resources in terms of contained nickel with approximately 13.8 million tonnes of nickel (1.22% Ni grade) and 1.0 million tonnes of cobalt (0.08% Co grade) within a 21,100 hectare concession area.

RKEF Smelters

(50.1% MBMA, 49.9% Tsingshan Group)

8 lines RKEF smelters in IMIP producing NPI for stainless steel production, with total expected nameplate capacity of 88,000-tonne of nickel per annum.

Nickel Matte

(60% MBMA, 40% Tsingshan Group)

A nickel matte conversion facility, located within IMIP, to produce high-grade nickel matte (> 70% Ni content), which is a key feedstock for battery precursors and Class 1 Nickel.

AIM Project

(80% MBMA, 20% Tsingshan Group)

A modern processing plant facility which will process high-grade

pyrite feedstock from Wetar Copper Mine to recover acid and

steam for use in HPAL plants, in addition to producing other metals

such as copper, gold and iron.IKIP

(32% MBMA, 68% Tsingshan Group)

IKIP is a future battery material focused industrial park, covering an area of approximately 3,500-hectares within the SCM Mine concession area.

HPAL

High Pressure Acid Leach (HPAL) is a process used to extract nickel and cobalt from laterite ore bodies. MBMA plans to develop 2 HPAL plants with a combined total capacity of 240 ktpa Ni within IKIP.

Other assets

Include a 50 km dedicated haul road connecting the SCM Mine and IMIP; and a 500-hectares limestone mining concession.

On 18 April 2023, MBMA successfully completed its Initial Public Offering on the Indonesia Stock Exchange and became a public company. The creation of a listed and vertically integrated battery materials company of global significance would position MBMA to maximise the value of its portfolio of high-quality assets and would provide access to new capital to allow it to pursue downstream expansion projects.